Florida offers a thriving commercial real estate market—but understanding how to evaluate commercial properties in Florida is essential before making any investment. From retail storefronts in Miami to industrial parks near Tampa, evaluating a property properly can make or break your return. This guide outlines what experienced investors look for in 2025 when analyzing Florida’s most promising commercial assets.

Key Financial Metrics to Analyze

Before anything else, investors should assess the numbers. Here are a few essential metrics:

- Net Operating Income (NOI): Subtract operating expenses from gross income to determine true profitability.

- Cap Rate: Calculate by dividing NOI by the purchase price. A higher cap rate often means higher risk and return.

- Cash-on-Cash Return: Measures the return on actual cash invested—not just total cost.

- IRR (Internal Rate of Return): Useful for comparing multi-year investment returns over time.

These figures help you determine if the commercial property in Florida is under- or overvalued—and if it fits your risk profile.

Evaluating the Location

Location is everything when analyzing commercial properties in Florida, given the state’s diversity in city profiles and economic drivers. Consider:

- Growth trends: Is the area’s population and employment increasing?

- Zoning and usage: Make sure the intended business activity is permitted.

- Accessibility: Proximity to highways, airports, and ports affects asset value.

- Comps (comparable properties): Check what similar assets are selling or leasing for nearby.

Example: A retail center in Downtown Orlando will perform differently than one in a suburban corridor of Lakeland.

Looking for deal-ready properties? Browse commercial assets in Florida cities.

Physical & Structural Due Diligence

Beyond numbers and maps, investors must inspect the physical condition of the property:

- Building age and structure

- Roof, plumbing, electrical, and HVAC systems

- Environmental risks (flood zones, past contamination)

- Required repairs or compliance upgrades

These factors greatly affect total cost of ownership and long-term profitability.

Tenant & Lease Analysis (If Occupied)

If the property is leased:

- Evaluate current tenant profiles and their reliability

- Check lease types (NNN, gross, modified)

- Understand lease terms, expirations, and renewal clauses

- Look for rent escalations and future vacancy risk

Strong, long-term tenants like medical groups or national retailers add value to commercial properties in Florida, especially in competitive markets.

Legal & Regulatory Review

This step is often overlooked and can be costly. Don’t skip:

- Title and deed verification

- Zoning confirmations

- Easements or encroachments

- Outstanding permits, liens, or code violations

Consider support from experts offering Real Estate Transaction Advisory Services.

Bonus: Red Flags When Evaluating Commercial Properties

Even if the numbers look promising, there are certain warning signs that experienced investors know to watch for when evaluating commercial properties in Florida:

- Unstable or short-term tenants

- Deferred maintenance

- Limited parking or access

- Zoning mismatches

Performing a thorough property walkthrough, combined with review of the last 3–5 years of financials and occupancy history, helps uncover these red flags early.

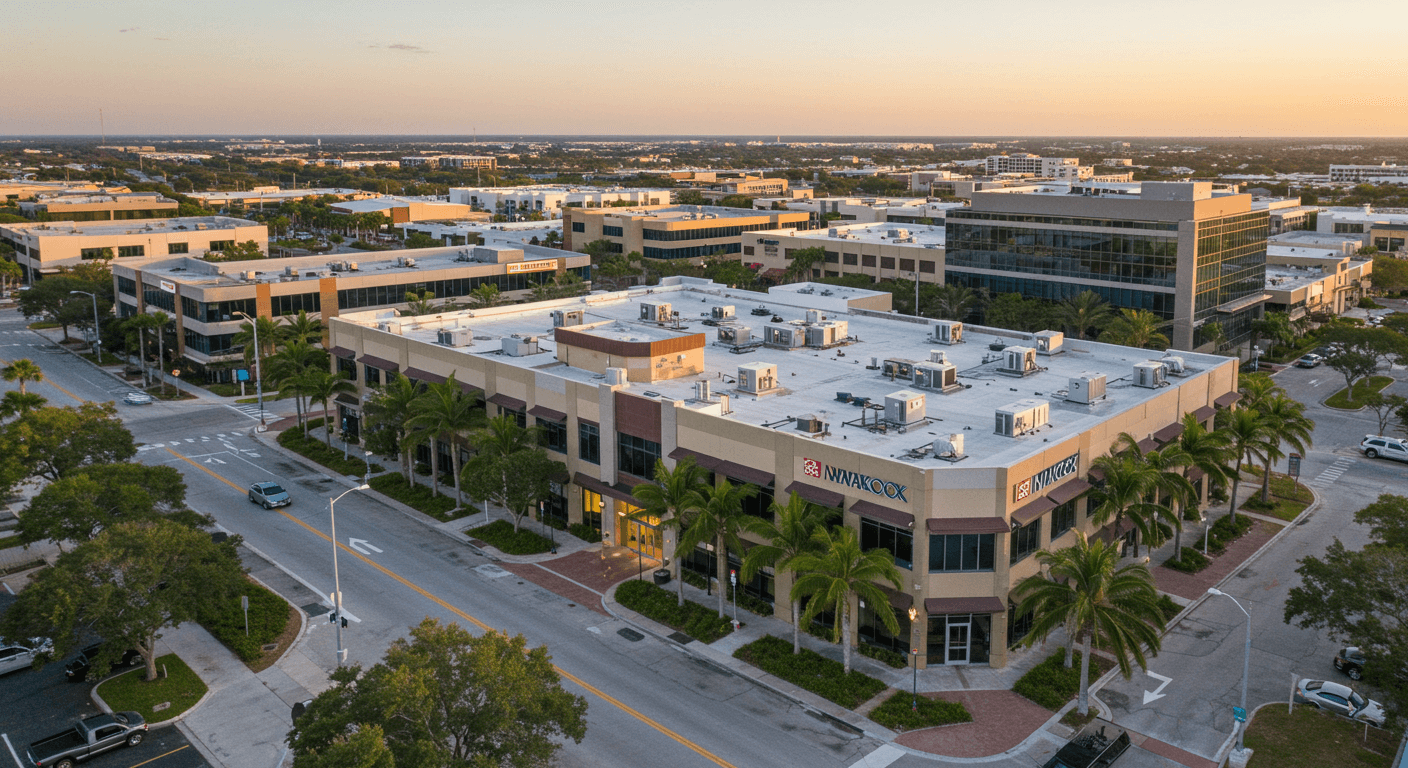

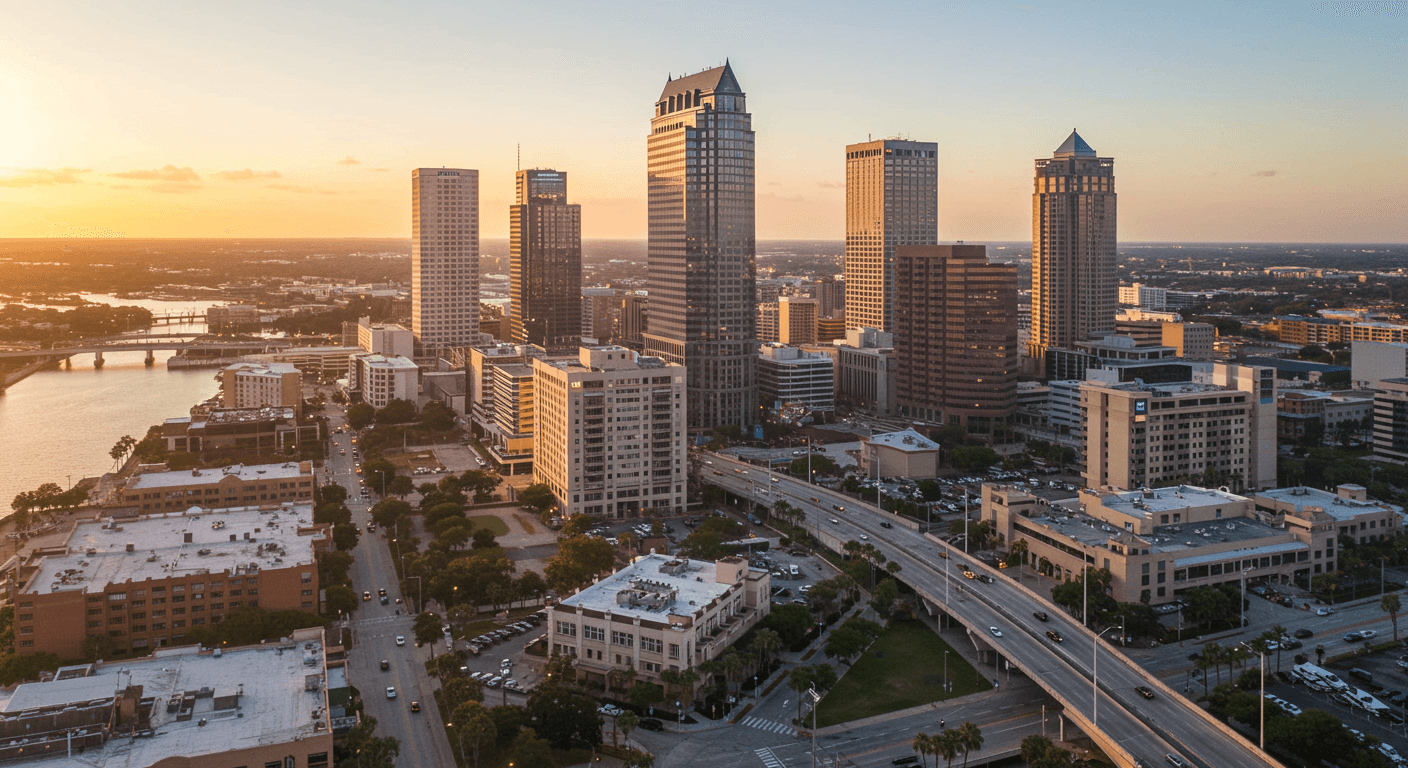

Market-Specific Considerations in Florida

Florida is not a one-size-fits-all market. Each region has unique factors that affect how commercial assets are evaluated:

- South Florida (Miami, Fort Lauderdale): High international demand, premium prices, strong hospitality and retail sectors.

- Central Florida (Orlando, Lakeland): Tourism, healthcare, and logistics are key drivers.

- North Florida (Jacksonville, Tallahassee): Strong growth in industrial and mixed-use development.

- Gulf Coast (Tampa, Sarasota, Naples): Rapid population growth, logistics infrastructure, and suburban retail expansion.

According to the Florida Department of Economic Opportunity, these regional differences are driven by factors such as workforce availability, infrastructure planning, and economic development goals.

Knowing the dynamics of each region can help you benchmark your expectations when analyzing commercial opportunities.

How GoCommercial Helps You Evaluate Before You Invest

GoCommercial combines expert insight with data tools and localized knowledge to help investors evaluate opportunities with clarity. Whether you’re reviewing a warehouse in Jacksonville or a retail plaza in Sarasota, our team supports your evaluation process from start to close.

Explore multifamily, office, and mixed-use opportunities across Florida.

Final Investment Tip

Smart investors don’t just evaluate properties — they evaluate timing and market positioning. Even a great asset can underperform if bought at the wrong price or in a declining location. That’s why having access to real-time data, local expertise, and professional guidance is essential in the Florida market.

At GoCommercial, we work with buyers across every major Florida metro to assess and compare properties with objective, performance-driven criteria.

Final Thoughts

Knowing how to evaluate commercial properties in Florida is key to investing with confidence. From financial analysis and due diligence to tenant health and local trends, your evaluation framework determines the success of your investment.Ready to evaluate and acquire commercial properties in Florida?

Browse our listings or speak with an advisor to get personalized support.